[ad_1]

As Bitcoin continues to evolve and grow, traders and investors are always searching for ways to make smart investment decisions. One valuable tool they use are on-chain indicators, providing valuable insights into the market’s performance and potential buying opportunities.

Among these indicators, the MVRV, NUPL, and Puell Multiple, which are all outside the ideal buying range for maximum profit.

Bitcoin Reaches Technical Resistance

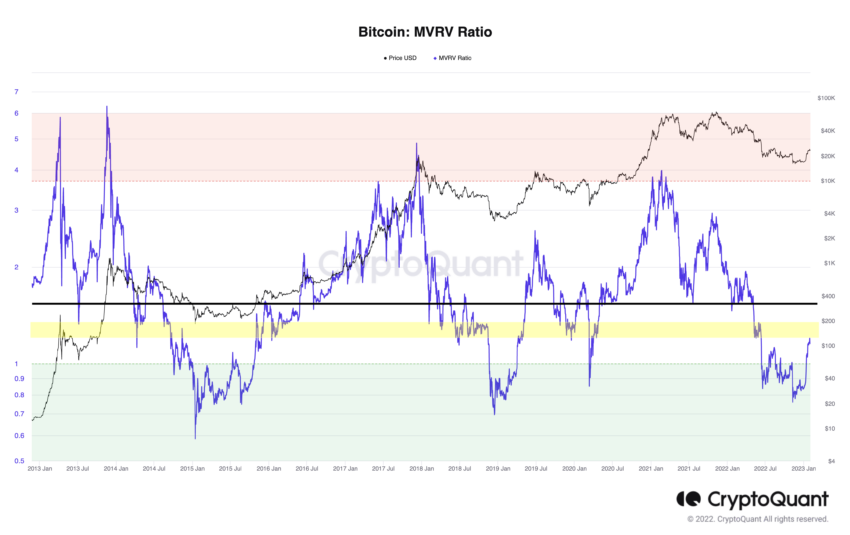

MVRV is an on-chain crypto market indicator that represents the relationship between the market capitalization and the realized capitalization of an asset. It’s calculated by dividing the market capitalization by the realized capitalization and is used to evaluate the current state of the market and make investment decisions. A value below 1 is considered an opportunity for buying and a value above 1 is considered a sign of overvaluation.

The MVRV ratio is currently at 1.16, as it has come out of the buying zone below 1. As this indicator is currently facing stiff resistance, it is important to watch out for a break of the 1.19 level. Overcoming this hurdle could trigger an upswing toward 1.34, which has historically proven to be a hard wall to break.

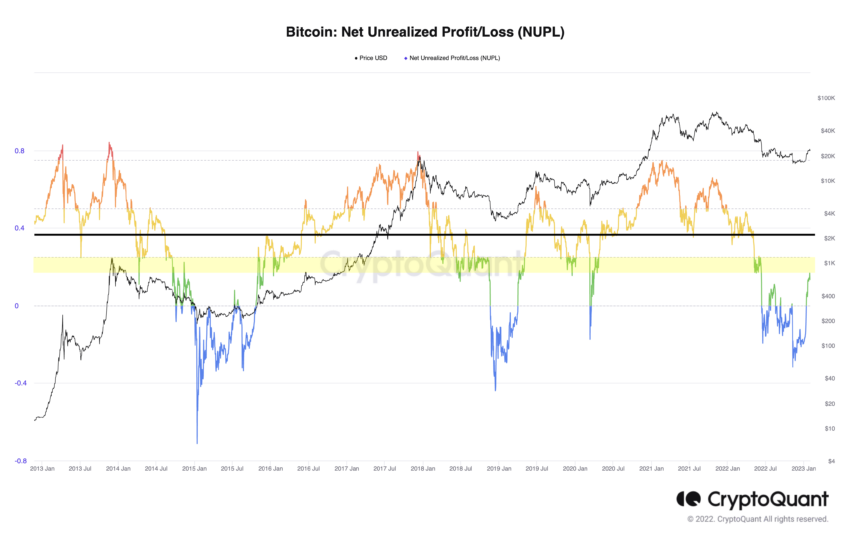

The NUPL is a cryptocurrency metric used to track the distribution of profits and losses among holders of a particular token. It measures the current value of the tokens held by a user relative to the price at which they were acquired. The NUPL metric can provide insights into the overall sentiment of a cryptocurrency’s investors and traders, and is a useful tool for making investment decisions.

The NUPL has seen a recent increase, leading to a dramatic rise in its value, currently at 0.14, higher than before the FTX crash. Nonetheless, investors who bought before May 9, 2022, are still not in profit and may sell when they break even, with a downswing below the 0 level, presenting an ideal buying opportunity.

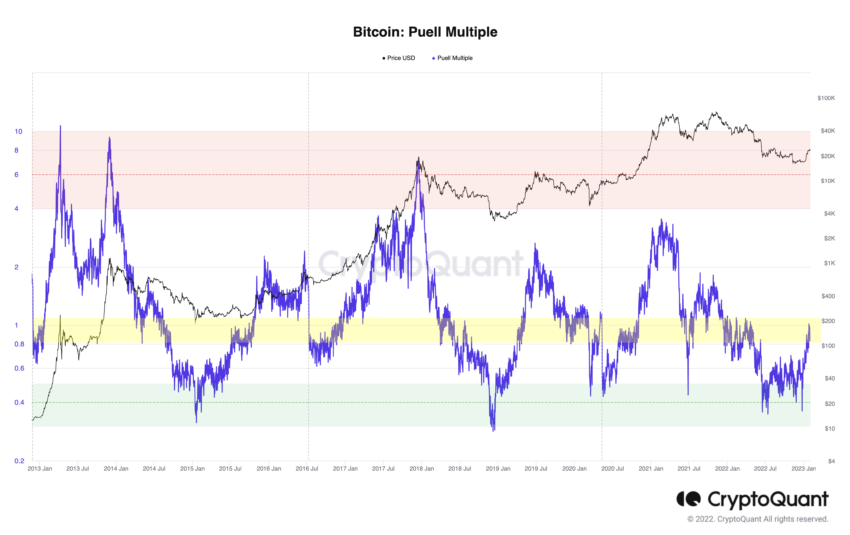

The Puell Multiple is a metric used to measure the rate of return on investments in the cryptocurrency market. It is calculated by dividing the total daily mining revenue by the total daily mining costs. A Puell Multiple below 0.5 is considered an ideal buying opportunity for maximum profits. A Puell Multiple above 1 is considered a warning sign, as it could indicate a market bubble.

The Puell Multiple is also an important indicator to watch, currently at 0.99 and facing significant resistance. The ideal buying opportunity for this indicator is below 0.5, with the top of the range being 1.08.

Wait or Buy?

With all three of these on-chain indicators currently outside the ideal buying range for maximum profit, traders and investors face a decision. They must wait for the indicators to move back into the ideal buying zone or take a risk and buy on the next breakout with an aggressive profit strategy.

Understanding these indicators and their movements is crucial for making informed investment decisions in the highly volatile and unpredictable cryptocurrency market.

Disclaimer

BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

[ad_2]

Source link