[ad_1]

Former Binance.US executive Catherine Coley has asked Sullivan & Cromwell lawyer James McDonald to represent her amid the CFTC’s lawsuit against Binance.

Coley helped launch Binance’s U.S. affiliate, Binance.US, in 2019 but departed two years later.

Coley Departed Over Zhao’s Governance of Binance.US

According to sources close to her departure, the former Wall Street trader left Binance in 2021 over Binance CEO Changpeng Zhao’s governance of Binance.US.

Once an avid social media poster, Coley has yet to make any public comments since her departure in 2021.

Coley’s legal counsel is a partner at Sullivan & Cromwell, the legal firm representing Binance rival FTX in its bankruptcy case in Delaware.

Coley’s enlisting of McDonald comes after the U.S. Commodity Futures Trading Commission sued the exchange and its CEO for promoting its derivatives trading desk to so-called VIP U.S. trading firms without being registered with the agency. The CFTC also charged the exchange with operating a weak compliance program.

The CFTC started investigating Binance in 2021 over alleged unlawful trading, which, later that year, morphed into insider trading charges. In the recent lawsuit, the agency alleged that 300 internal accounts are exempt from internal regulations prohibiting insider trading.

Since May 2021, the U.S. Department of Justice said it was investigating Binance’s potential tax evasion and compliance with KYC/AML rules. In December, attorneys for the exchange entered into negotiations with prosecutors, who were contemplating aggressive action against the exchange.

The U.S. Securities and Exchange Commission has also requested information on how Binance.US, a spot-trading platform targeted at U.S. customers, relates to its global affiliate.

Corporate Actions Contradict Public Claims

The recent CFTC allegations implying that Binance allegedly exempts 300 accounts from insider trading rules have reflected a trend towards the exchange protecting its corporate interests while maintaining a benevolent exterior.

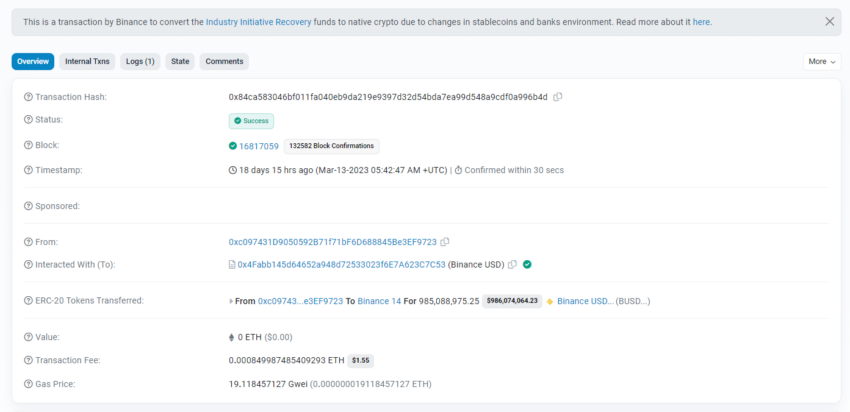

After the collapse of FTX, he announced that Binance would launch a $1 billion recovery fund to help ailing crypto firms, he emphasized that all the fund’s transactions would be publicly visible.

However, in one transaction earlier this month, the exchange moved almost $1 billion of the fund’s BUSD holdings into a corporate wallet. It didn’t specify how it would convert the funds into Bitcoin, Ether, and BNB after U.S. regulators ordered BUSD issuer Paxos to stop minting the coin.

“We will keep funds available, as needed, but they will sit in our corporate wallets rather than in the IRI wallet,” a spokesperson told Fortune.

Furthermore, reports surfaced in early January that so-called B-tokens, which are BNB Chain versions of assets that customers deposit, were not backed by sufficient collateral.

Binance had also reportedly mixed customer and corporate funds in a single wallet. It later admitted its error and said it would only mint B-tokens if the customer wallet had the required collateral.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link