[ad_1]

The cryptocurrency market is currently undergoing a downturn, and we’re on the verge of potential chaos caused by FTX’s liquidators. However, Michael Saylor believes there are three factors that could soon drive Bitcoin (BTC) prices significantly higher.

This optimistic outlook comes from the MicroStrategy’s co-founder, who is an ardent supporter of Bitcoin. His recent remarks have rekindled hope among the community, suggesting that Bitcoin could potentially be worth $5 million one day.

What Underpins Michael Saylor’s Predictions?

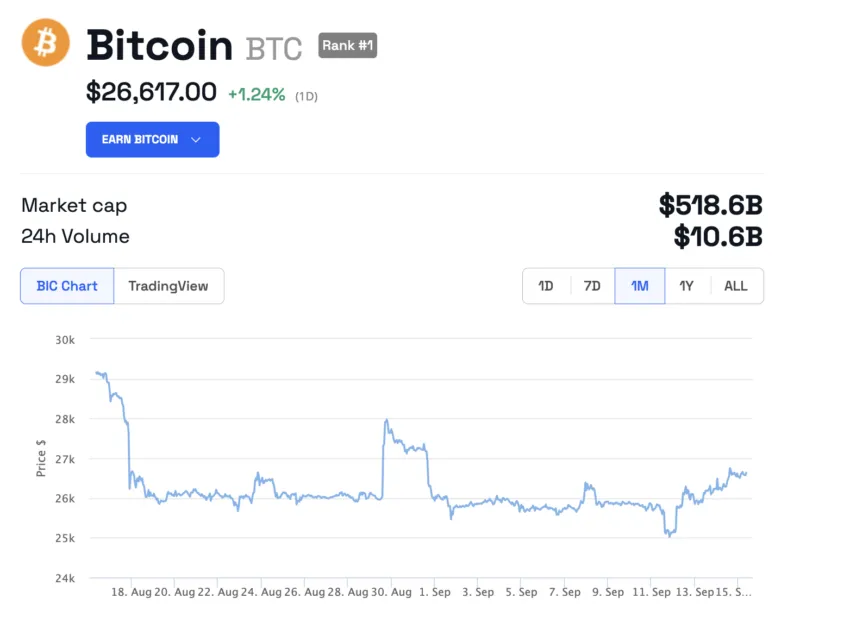

As of writing, Bitcoin is trading at $26,617, up by 1.24% in the past 24 hours.

Saylor’s projection is a 50 times higher than the most optimistic expert forecasts to date. But is such a massive valuation for a digital asset even possible?

For this to happen, three conditions need to be fulfilled: the launch of spot Bitcoin ETFs, banks offering financial services using BTC, and the official regulation of cryptocurrencies in the United States.

Fortunately, two of these conditions are almost met. Many speculations say the first spot Bitcoin ETFs will be launched this fall. X (Twitter) account @BTC_Archive highlights this by quoting Michael Saylor.

MICHAEL SAYLOR: 3 catalysts will take Bitcoin’s to $5 Million:1. Spot ETF approval: Inevitable2. Banks custody and lend against Bitcoin as collateral – coming soon.3. Fair value accounting rules from FASB – Approved this week.

BeInCrypto reported earlier that the Financial Accounting Standards Board (FASB) is working on a new accounting standard for companies holding cryptocurrencies. Companies will have to report their profits and losses immediately, rather than just once a year, increasing transparency for investors and the public.

Click here to learn how to buy Bitcoin with Google Pay.

What About Third Condition?

Banks seem to be interested in Bitcoin, especially if they feel threatened by more efficient financial systems such as XRP.

Some banks, such as Deutsche Bank, have already started offering cryptocurrency services. Other competitors are also gearing up to do the same. The @WuBlockchain account cites the example of South Korea’s Hana Bank:

KEB Hana Bank, one of South Korea’s largest financial institutions, announced a partnership with cryptocurrency custody company BitGo Trust Company to provide digital asset custody services starting in the second half of 2024.

This is, for example, the case of the Korean bank Hana Bank, which, in cooperation with BitGo, is launching an asset storage service. However, as Michael Saylor points out, this condition will only be fulfilled if banks start lending money against Bitcoin as collateral.

Currently, this rule only applies to cryptocurrencies in companies, but if this continues, banks may soon feel that this is the way forward.

Click here to learn about the 13 best non-KYC crypto exchange for 2023.

Do you have anything to say about Michael Saylor’s Bitcoin prediction or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link