[ad_1]

Decentralized finance protocol Lybra Finance’s LBR native token experienced heavy price volatility during the past week as its major supporters dumped their assets.

Lybra Finance, the creator of the yield-bearing eUSD stablecoin, aims to maintain a steady $1 peg and generate income from collateralized liquid staking tokens. In January 2023, the DeFi protocol reached a peak TVL of almost $400 million.

LBR Price Falls 50%

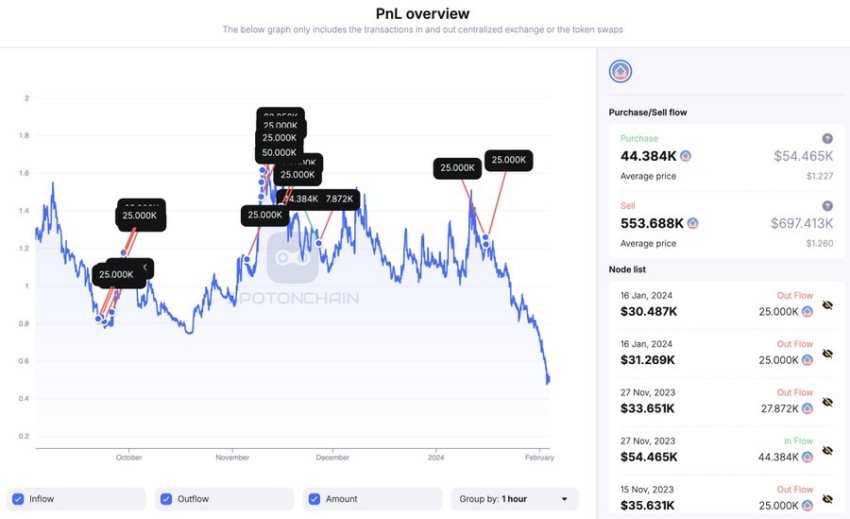

SpotOnChain, a prominent blockchain analytical firm, reported that Key Opinion Leaders (KOLs) and anonymous addresses holding substantial quantities of LBR tokens controlled a significant portion of the network’s Total Value Locked (TVL).

LBR’s downward spiral began when these substantial holders began divesting their assets. On January 15, the top protocol’s staker, blurr.eth, removed all their 34,000 ETH ($70 million), while other major stakers—sifuvision.eth and czsamsunsb.eth—dumped 6,000 ETH ($13 million) and 4,000 ETH ($8 million), respectively, today.

These actions resulted in LBR’s value plunging by around 14% during the past day to $0.4263 as of press time. Over the past week, LBR experienced a substantial decline of around 50%.

“Influential Key Opinion Leaders (KOLs) have dumped their tokens. It’s uncertain if LBR can make a comeback,” blockchain analytical firm SpotOnChain wrote.

Meanwhile, the heightened selling pressure negatively impacted the eUSD stablecoin, which briefly deviated from its peg, dropping to as low as $0.97. While it has recovered to $1.01 as of press time, it’s worth noting that its trading volume remained below $4,000 in the last 24 hours, according to CoinMarketCap data.

DeFi TVL Dips 70%

As a result of these developments, the total value of assets locked on the DeFi protocol rapidly tanked by approximately 70% during the past day to $79 million from $245.85 million, according to DeFiLlama data.

Industry experts suggested that the rapid decline was caused by whales withdrawing their ETH and moving to other protocols with better yields.

“People simply have better ways to use their ETH — that is all there is to it… why would people stick their ETH in Lybra when they can restake it, get a LRT, get tons of EL + other points, and borrow stables against those positions,” crypto analyst Yoki said.

Lybra Finance attributed the decline to user behavior, adding that the protocol and its users’ funds remain safe.

“We are aware of the sudden drop in TVL, which was caused by user behavior. The protocol is secure, and users’ assets are not affected. Please don’t panic,” the Lybra team said.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

[ad_2]

Source link