[ad_1]

BlackRock and Monochrome Asset Management have announced significant expansions in the United States and Australia, respectively. This marks a notable leap in the accessibility and appeal of Bitcoin exchange-traded fund (ETFs) to a broader investor base.

Indeed, this initiatives reflect the evolution of the cryptocurrency investment and highlight the sector’s potential for continued growth and integration into wider financial markets.

Bitcoin ETFs Rise in US and Australia

BlackRock, the world’s largest asset manager, has expanded its spot Bitcoin exchange-traded fund (ETF), IBIT, in the US. The firm added five new Authorized Participants (APs), enhancing the fund’s accessibility and liquidity for investors. These include ABN AMRO Clearing USA LLC, Citadel Securities LLC, Citigroup Global Markets, Inc., Goldman Sachs & Co. LLC, and UBS Securities LLC.

These entities are essential in the ETF’s operation, facilitating the creation and redemption of shares. With a total of nine APs, IBIT, operational since January 11, 2024, stands as a signal of the growing confidence in and demand for Bitcoin as a legitimate asset class.

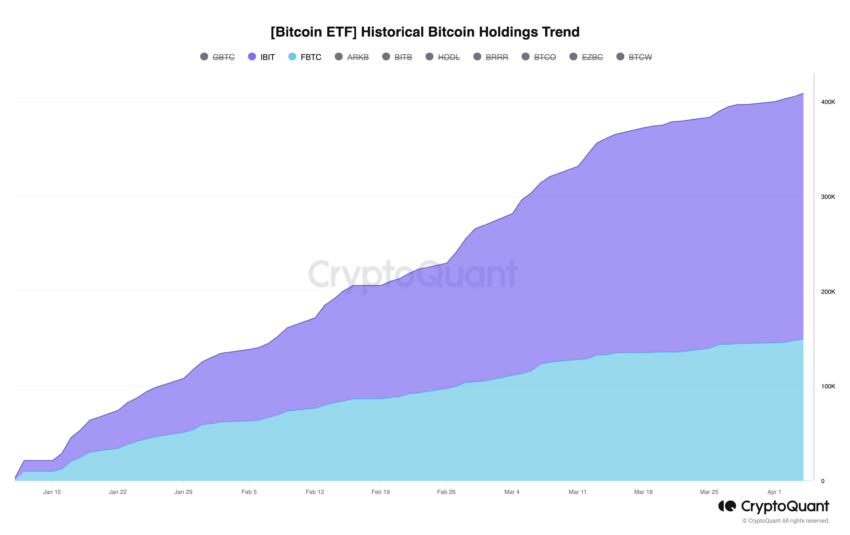

Indeed, it is part of a wider acceptance of Bitcoin within mainstream financial market, highlighted by the notable investor interest in comparable funds such as Fidelity’s Wise Origin Bitcoin Fund (FBTC). Both IBIT and FBTC have made impressive strides, amassing investments totaling 259,381.19 BTC and 149,339.22 BTC, respectively, to date.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

Meanwhile, in Australia, Monochrome Asset Management is making strategic moves by shifting its flagship Monochrome Bitcoin ETF application to Cboe Australia. By aligning with Cboe, known for its extensive history and innovation in financial markets, Monochrome aims to tap into the vibrant Asian investment landscape.

This decision underlines Monochrome’s commitment to offering investors a novel way to diversify their portfolios with digital assets.

“We are proud to work with Cboe Australia to bring Monochrome’s new Bitcoin ETF to market, expanding the investment universe for Australian Investors. As leaders in digital assets globally, their established track record and commitment to innovation and safe market accessibility aligns with Monochrome’s strategic objectives” Jeff Yew, CEO at Monochrome, said.

The addition of heavyweight financial institutions as APs for BlackRock’s IBIT and Monochrome’s strategic decision to list its Bitcoin ETF on Cboe Australia demonstrates the increasing mainstream acceptance of Bitcoin.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

[ad_2]

Source link