[ad_1]

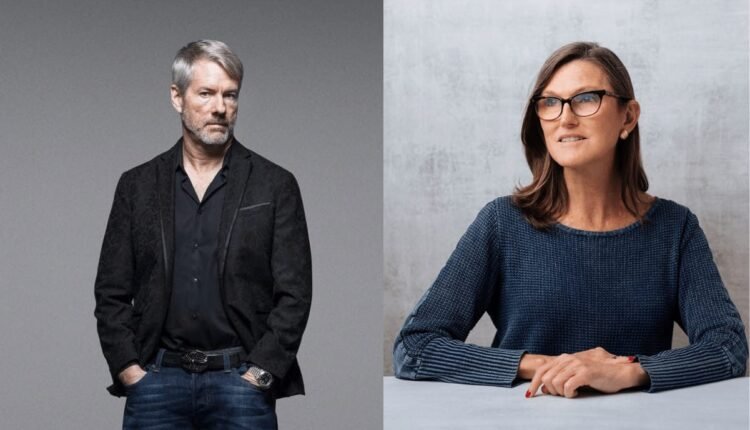

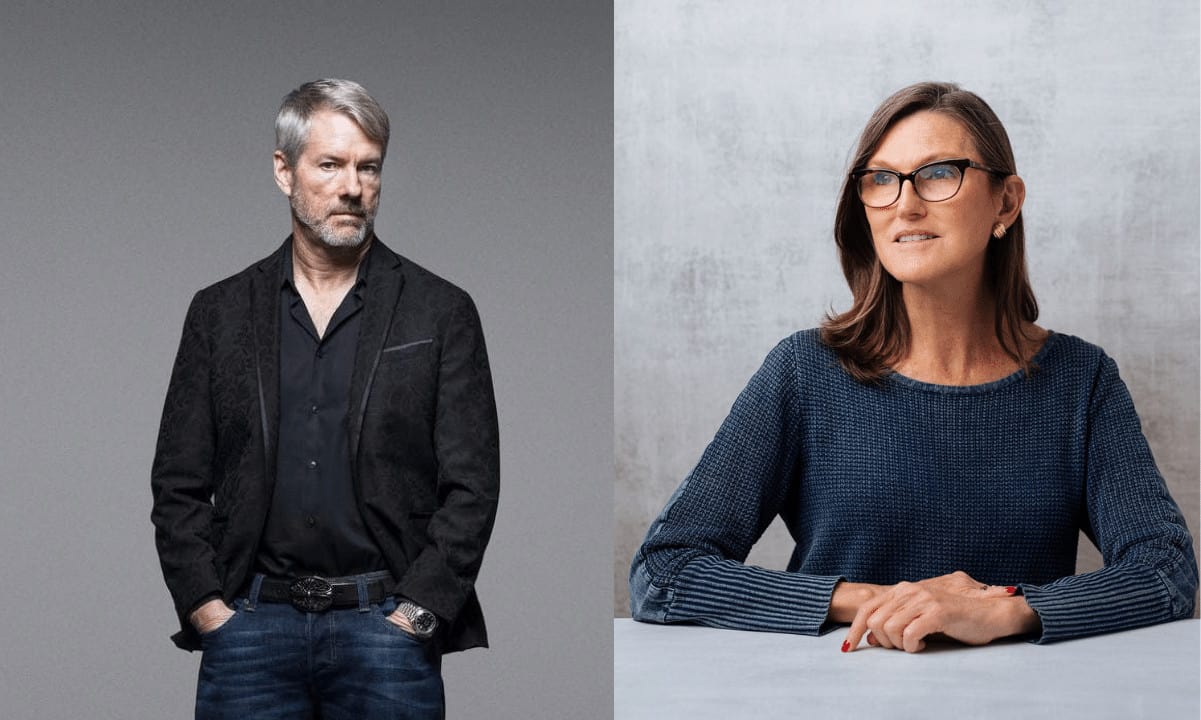

Michael Saylor, the CEO of Microstrategy, and Cathie Wood, CEO of Arch Invest, held a panel at the Miami 2022 Bitcoin conference on Thursday.

The two tech investors shared an optimistic vision for the largest cryptocurrency, setting ambitious price targets.

“People ask me if I’m still bullish on Bitcoin. I am more bullish than ever on Bitcoin. The future is bright,” Saylor said.

Wood: Someone is Whispering in Politicians’ Ears

Both Wood and Saylor believe that regulatory winds are shifting in Bitcoin’s favor.

“I see the politics around Bitcoin radically. It has become a single issue that people are voting on – and it’s bipartisan,” Wood said.

Wood remarked that just a year ago, Treasury secretary Janet Yellen spoke about Bitcoin in largely negative terms referencing “money laundering, nefarious characters, environmental damage,” etc.

However, Wood says that Washington insiders have since changed their tune.

“Someone is whispering in their ear… if you want to lose out, and if you want the US to lose our… keep talking on that. And she has changed her tune,” she added.

Saylor: Biden’s Green Light for Bitcoin

On the other hand, Michael Saylor is bullish on President Joe Biden’s recent crypto announcement. Namely, Biden directed all federal agencies to research digital currency, a move which Saylor called a “green light” for Bitcoin.

“Bitcoin has been embraced. The administration has given a green light to Bitcoin” said Saylor. “Politicians are now competing who’s the most pro-bitcoin,” he added.

Saylor believes the announcement is a massive boost for BTC adoption as it could be just what institutional investors need to jump in and invest in the asset.

Wood brought up recent remarks by Securities and Exchange Commission Head Gary Gensler, where he asserted, that Bitcoin is not a security.

This is important as it reduces the regulatory risk for Bitcoin and Wood believes this makes the cryptocurrency stand out even more among other digital assets.

Bitcoin – Good for Inflation and Deflation

After discussing political risks for Bitcoin, Wood and Saylor moved to economic risks. Tech investors don’t agree on the macroeconomic outlook for the world. Namely, Saylor believes the monetary policy will continue to be inflationary, pushing prices up.

On the other hand, Wood asserted that tech innovation will create huge deflationary pressures that will offset the Fed’s money printing.

“We had a spirited discussion about inflation… I would say that if inflation is an issue, clearly Bitcoin is s huge hedge,” Wood said.

Moreover, Wood believes Bitcoin could also be useful as a hedge against deflation and against counterparty risk. Namely, there is no third party that seizes Bitcoins from someone’s wallet.

Tech – Use Lightning or Die

Saylor remarked that he sees great tailwinds for Bitcoin Lightning Network adoption. The latter is a low-cost, open-source instant payment platform.

“Every tech entrepreneur, every exchange will have to include Lightning, if it wants to be viable,” complimenting Block’s Cash App and BitPay for driving adoption.

Sayor remarked that the “killer application” for Lightning could be bringing stablecoins to the network. Recently, Lightning Labs raised $70 million to do just that.

$1 Million Price Target

On the technology side, Woods sees a lot of potential for further growth by removing friction for customers.

Making the process of trading and transacting with crypto more streamlined will bring in more users, Wood believes.

On the price side, she said her fund Arch Invest is looking at a price target of $1 million for a Bitcoin.

“We don’t need much. All we need is that 2.5% of all assets is allocated in Bitcoin,” she explained.

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

PrimeXBT Special Offer: Use this link to register & enter POTATO50 code to receive up to $7,000 on your deposits.

[ad_2]

Source link