[ad_1]

After the previous week, which saw the deterioration of one of the largest crypto exchanges, this one was significantly less volatile in terms of price movements but quite eventful for reports popping left and right that revealed intriguing information regarding SBF, FTX, Alameda, and other involved parties.

Let’s start with the price developments. The primary cryptocurrency had already suffered a lot from the FTX meltdown, dropping from over $21,000 to a two-year low of $15,500 last week. It tried to recover some ground during the weekend and briefly hopped to $17,000 before it plummeted below $16,000 on Monday.

After another volatile trading day, BTC returned to $17,000 and spent most of the next few days there. It tried to conquer that line on a few occasions but to no avail, with the latest rejection coming just hours ago.

Most of bitcoin’s price movements were related to new information concerning FTX, Alameda, or the person behind both entities – Sam Bankman-Fried. Similarly, projects highly related to them were also affected, even worse. Such is the case with Solana, which saw companies like Tether tried to distance themselves. Ultimately, this pushed SOL’s price further south.

The overall situation with the crypto market is rather gloomy on a weekly scale, though. Ethereum is down by 5%, Binance Coin by 8%, Cardano by almost 10%, while MATIC has seen an 18% decline.

The cumulative market cap of all crypto assets has gone down to $833 billion on CoinMarketCap. BTC’s dominance stands at 38.5%, while its own market cap is struggling to remain above $320 billion.

Market Data

Market Cap: $833B | 24H Vol: 49B | BTC Dominance: 38.5%

BTC: $16,630 (-2%) | ETH: $1,212 (-5%) | BNB: $271 (-8%)

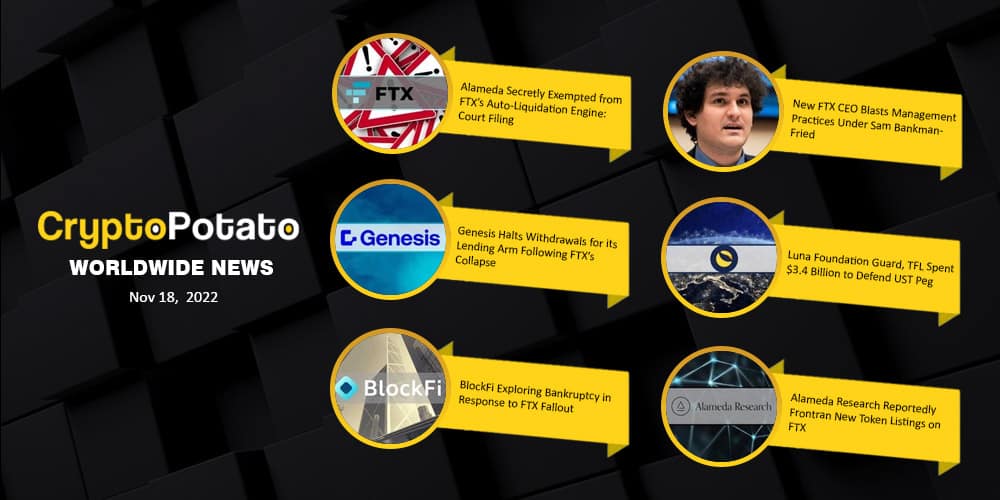

Can’t-Miss Crypto Headlines From This Week

Alameda Secretly Exempted from FTX’s Auto-Liquidation Engine: Court Filing – The new CEO of FTX, who stepped up to take charge during the company’s troubled times, revealed some shocking details about how both entities were run. One of them indicated that Alameda was secretly exempted from FTX’s auto-liquidation engine.

New FTX CEO Blasts Management Practices Under Sam Bankman-Fried – The CEO went into more detail about the failed practices at FTX and said he had never “seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here.”

Genesis Halts Withdrawals for its Lending Arm Following FTX’s Collapse – Being one of the largest crypto exchanges with relations to many other industry companies, FTX’s collapse meant that many other participants will eventually get hurt. One of the first to stop withdrawals for its lending arm was Genesis.

Luna Foundation Guard, TFL Spent $3.4 Billion to Defend UST Peg: Report – A rare non-FTX news from this week came from a report claiming that the Luna Foundation Guard and Terraform Labs had spent over $3 billion trying to defend UST after it lost its peg against the dollar.

BlockFi Exploring Bankruptcy in Response to FTX Fallout: Report – Another company with ties to FTX that is suffering from the adverse developments is BlockFi. Although the rumors are still unconfirmed, some reports claim that the crypto lender has begun exploring bankruptcy following the FTX collapse.

Alameda Research Reportedly Frontran New Token Listings on FTX – More shocking news about Alameda and FTX – this time, WSJ reported that SBF’s trading arm – Alameda Research – frontran new token listings on FTX, which is highly illegal.

The post Alameda, FTX in the Spotlight, BTC Loses $17K as Contagion Spreads: This Week’s Recap appeared first on CryptoPotato.

[ad_2]

Source link