[ad_1]

Coinbase announced it would add support for the ERC-20 token BLUR, the governance token of pro-NFT trading marketplace Blur.io.

Coinbase said they would launch trading of the BLUR-USD pair when there is sufficient BLUR liquidity. The exchange will label BLUR as an experimental token, which will not be available in all jurisdictions.

BLUR Governance Tokens

The Blur marketplace, geared towards pro traders, airdropped BLUR governance tokens in care packages to early traders in October 2022. At the time, Blur.io said it would unlock the tokens in Jan. 2023 but later postponed the rollout to Feb. 14, 2023, amid technical challenges.

Crypto projects use airdrops to generate buzz. In most cases, users qualify to receive free crypto coins by performing certain tasks that draw attention to a particular project.

Blur’s care packages have three rarity levels: uncommon, rare, and legendary, with the legendary rarity level containing the most BLUR. Blur’s first round of airdrops awarded active traders in the six months following Blur’s launch with uncommon care packages. The second airdrop took place in Nov. 2022 and rewarded traders with rare care packages. The third airdrop, whose tokens will also be unlocked on Feb. 14, 2023, received legendary packages.

At press time, BLUR was trading at $25.25, up 500% on the day in anticipation of the token unlock.

New Marketplace Outperforms OpenSea and Coinbase

In other news, Coinbase’s much-ballyhooed NFT marketplace has struggled to compete with incumbent OpenSea, let alone Blur itself.

On Feb. 2, 2023, Fortune reported that the marketplace had processed a paltry $150 in trading volume and $1,500 in the week ending that date. Comparatively, OpenSea recorded trading volumes of $10 million between Jan. 26, 2023, and Feb. 2, 2023.

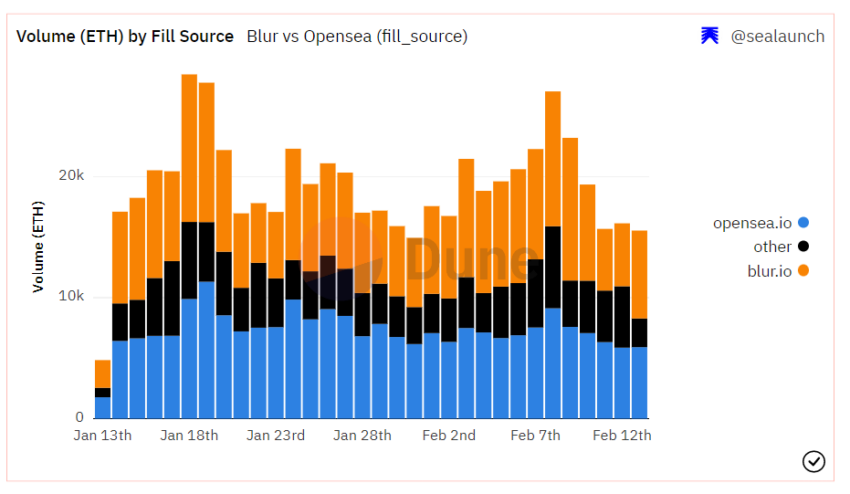

Trading volumes Blur.io’s marketplace beat OpenSea for 12 out of 13 days in February, according to a Dune Analytics dashboard. Sales peaked at about $17 million on Feb. 9, 2023, compared to OpenSea’s $14 million.

At the time, Coinbase denied that its pause of new artist drops signaled the platform’s demise, saying it was working on improving tools requested by artists.

Coinbase Will Fight SEC Over Staking Product if Necessary

Coinbase CEO Brian Armstrong said the company’s legal team would fight allegations that its institutional crypto-staking product was a security. Staking allows those wishing to participate in blockchain security to earn rewards for validating transactions.

His tweet came after the U.S. Securities and Exchange Commission filed an enforcement action against Coinbase competitor Kraken for offering its staking service as alleged unregistered security to U.S. customers. Kraken paid the SEC a $30 million settlement without admitting to or denying wrongdoing but withdrew its staking product from the U.S. domestic market.

Coinbase fired former product manager Ishan Wahi last year for his involvement in an insider trading case, revealing several tokens that would be listed on the platform 24 hours before their original listings. He will be sentenced at a May 10, 2023 hearing. Wahi’s younger brother is already serving a 10-month sentence for earning profit through Ishan Wahi’s leak.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

BeInCrypto has reached out to company or individual involved in the story to get an official statement about the recent developments, but it has yet to hear back.

[ad_2]

Source link