[ad_1]

The Securities and Exchange Commission (SEC) named these cryptos as securities in its lawsuit against Binance and Coinbase on June 8. While this caused an initial sell-off, most of them have recovered since to pre-crash levels.

On June 8, the SEC launched lawsuits against cryptocurrency exchanges Binance and Coinbase. The charges against them range from a simple lack of disclosure to serious regulatory violations. The essence of this lawsuit boils down to the Howey Test, a legal framework that determines if an investment is a “security.”

The full list of cryptocurrency tokens that have been labeled as securities is as follows:

Cosmos (ATOM)

Binance Coin (BNB)

Binance USD (BUSD)

COTI (COTI)

Chiliz (CHZ)

Near (NEAR)

Flow (FLOW)

Internet Computer (ICP)

Voyager Token (VGX)

Dash (DASH)

Nexo (NEXO)

Solana (SOL)

Cardano (ADA)

Polygon (MATIC)

Filecoin (FIL)

The Sandbox (SAND)

Decentraland (MANA)

Algorand (ALGO)

Axie Infinity (AXS)

If these tokens are ultimately classified as securities, they would be delisted from US exchanges.

SEC chairman Gary Gensler states that “everything other than Bitcoin” can be labeled as a security. While Mr. Gensler is now a proponent of cracking down on cryptocurrencies, he was a more positive figure during his teaching period in 2018 when he taught a blockchain course at MIT.

At the time, he said in a lecture, “Three-quarters of the market is non-securities. It is just a commodity, a cash crypto.”. Thus, his position now is a direct contradiction to that of 2018.

However, not all in the financial community share Mr. Gensler’s belief. He has recently come under fire from various lawmakers, who are introducing a bill that could replace him as the head of the SEC.

Coins are Pumping Despite SEC Lawsuit

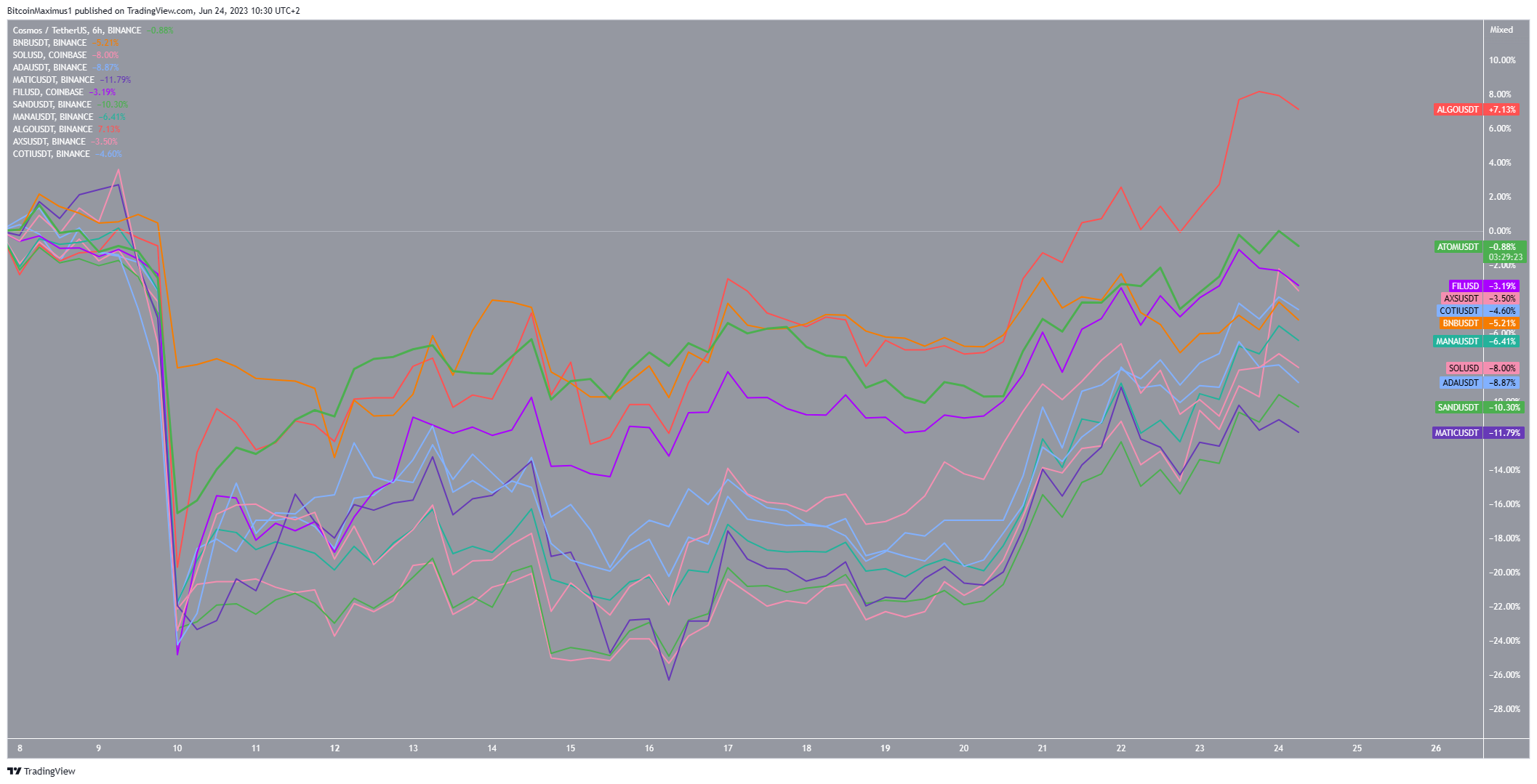

While the introduction of the lawsuit caused a sharp crash on June 8, the market has recovered since. Interestingly, some of the tokens named as securities are leading this charge.

Algorand (ALGO) has increased by nearly 6% (red) since June 8, while Cosmos (ATOM), Filecoin (FIL), Axie Infinity (AXS), and Coti Network (COTI) have recovered nearly all of their losses since the crash.

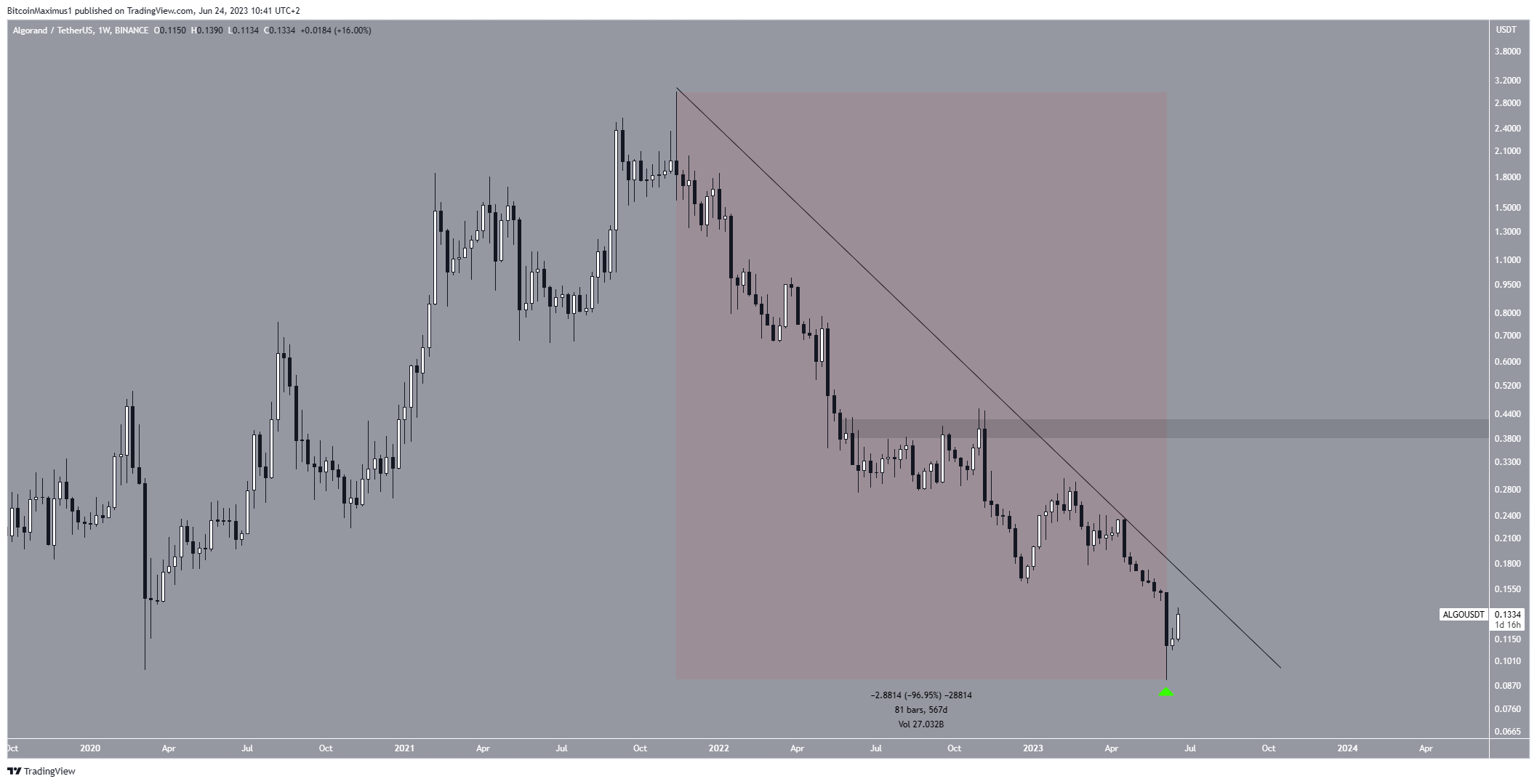

Algorand (ALGO) Price Leads the Charge

The ALGO price has experienced a difficult time since November 2021, falling by 97% in 567 days. During the week of the lawsuit (green icon), ALGO briefly fell below the March 202 lows of $0.095. However, the price has recovered admirably since and is now trading at $0.13.

Moreover, the price is approaching the aforementioned long-term descending resistance line. If it breaks out, it will mean that the preceding correction is complete and a new upward trend has begun. This could initiate a rally to the closest resistance area at $0.41.

However, if the price gets rejected at the resistance line again, a drop to the next closest support area at $0.05 could ensue. This would amount to an all-time low price.

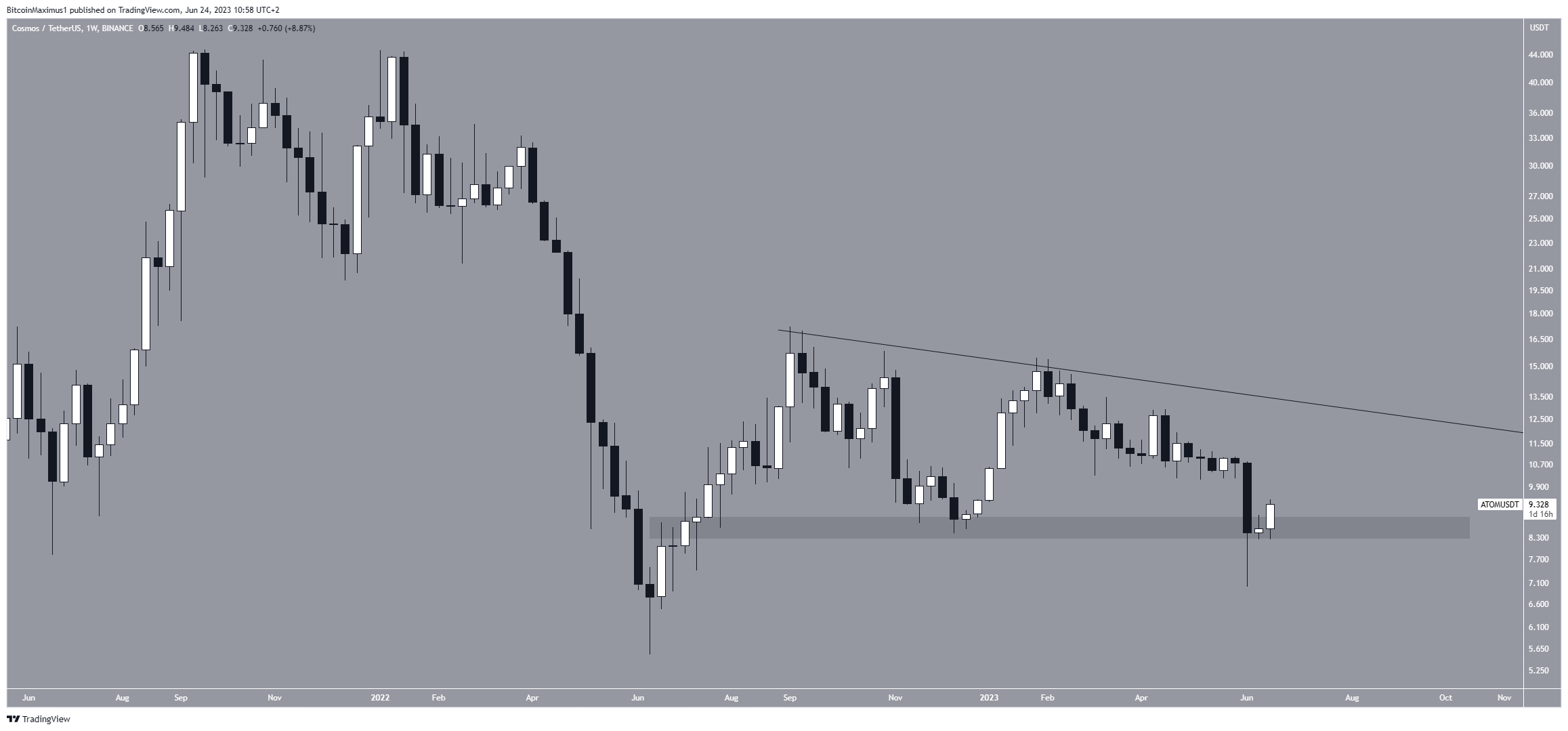

Cosmos (ATOM) Attempts to Reclaim Key Level

Unlike ALGO, the ATOM price is not yet close to its 2020 lows. Rather, the price has fallen to a new yearly low but is considerably above even its 2022 lows.

During the week of the SEC lawsuit, ATOM briefly fell below its $8.50 horizontal support area. However, the price has recovered since, creating a long lower wick in the process (green icon).

Additionally, it reclaimed the horizontal area and validated it as support. If the current close holds, it would be a decisive bullish development since it would indicate that the previous breakdown was not legitimate. In that case, the ATOM price could increase to the next closest resistance at $12.

On the other hand, if the ATOM price reversed the trend and closed below $8.50, a sharp fall to $6 could ensue.

Filecoin (FIL) Nearly Reaches Resistance

Similarly to ATOM, the FILE price has fallen under a descending resistance line since the beginning of February. More recently, the line caused a rejection at the beginning of June, initiating a significant drop (red icon). This coincided with the SEC lawsuit.

However, the same week of the crash, FIL created a very long lower wick, which was considered a sign of buying pressure. This also validated the $2.90 horizontal area as support.

Currently, FIL is attempting to break out from the resistance line. If successful, it could surge to the next resistance at $3.90.

On the other hand, if the FIL price gets rejected, it could fall to the $2.90 horizontal area again, validating it as support.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions.

[ad_2]

Source link