Dollar to Play Lesser Role Due to Its Weaponization, Digital Currencies, Economist Jeffrey Sachs Says – Finance Bitcoin News

[ad_1]

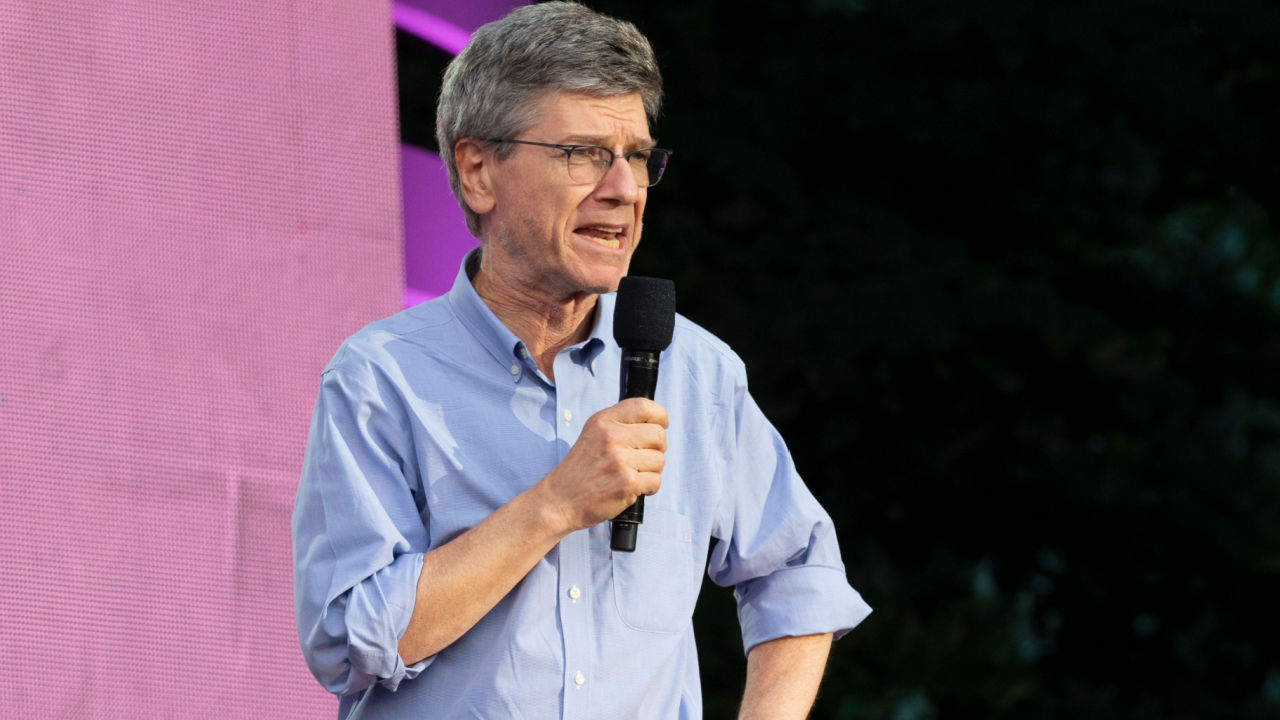

Within the next decade, the U.S. dollar will play a much less dominant role than it is today, according to Jeffrey Sachs. The renowned economist listed a few factors for the diminishing status of the greenback such as its use as a political weapon by Washington, the introduction of currencies like the digital yuan, and America’s shrinking share of the global economy.

United States’ Smaller Share in World Economy to Affect the Dollar

The role of the U.S. dollar will naturally decrease as the share of the United States in the planet’s economy becomes smaller and settlements in other currencies take hold, economics professor and Director of the Center for Sustainable Development at Columbia University Jeffrey Sachs predicted.

Speaking at an online session of the latest Annual Columbia China Summit on Friday, Sachs noted that the international payment system is currently based on the dollar, with up to 60% of foreign trade settlements conducted or denominated in the U.S. fiat, and around half of currency reserves based on it.

At the same time, the U.S. share of the global economy is around 15%, in purchasing terms. So the role of the dollar is far larger than the role of the U.S. economy, Sachs explained. He described the role of the greenback as “kind of historical” and reflecting the power of the United States in the 20th century.

Quoted by the Chinese Xinhua news agency, Jeffrey Sachs also pointed out that with the U.S. turning its currency into a political weapon, by confiscating foreign exchange reserves of Russia, Venezuela, and Iran, many countries don’t want to keep their money in dollars anymore. He elaborated:

They don’t trust the United States and they think the U.S. is going to confiscate their currency, especially if they get in some kind of foreign policy disagreement with the United States.

Role of Currencies Like Renminbi, Rupee, Ruble to Rise in Future

The economist further remarked that the current role of the U.S. currency is largely due to the dollar-based commercial banking system as the payments are usually settled through commercial banks. However, Sachs is convinced that in the future, payments are going to be settled through central bank digital currencies (CBDCs).

The digital yuan (e-CNY), the digital version of the renminbi issued by the People’s Bank of China, is now undergoing trials at the retail level within the country, but Sachs believes that it will eventually become an international payment system for cross-border settlements.

Russia, China, Saudi Arabia, India, and South Africa have been looking for alternative payments as they don’t want to use the U.S. dollar-based banking system and, according to Sachs, that’s understandable. The role of the U.S. dollar will diminish and the role of the renminbi, the rupee, the ruble, and other currencies will increase in the future, he concluded.

Jeffrey Sachs is known for his work as an economic adviser to governments from Latin America to Eastern Europe, where he supported the transition to market economies. Two years ago, Sachs criticized bitcoin for offering “nothing of social value” but acknowledged some of the benefits of using digital currencies, including more efficient transactions.

Do you agree with the predictions made by U.S. economist Jeffrey Sachs? Share your thoughts on the subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, lev radin / Shutterstock.com

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

[ad_2]

Source link