Ebb and Flow of Stablecoin Economy Continues With BUSD’s Market Cap Dropping Below $10 Billion Range – Altcoins Bitcoin News

[ad_1]

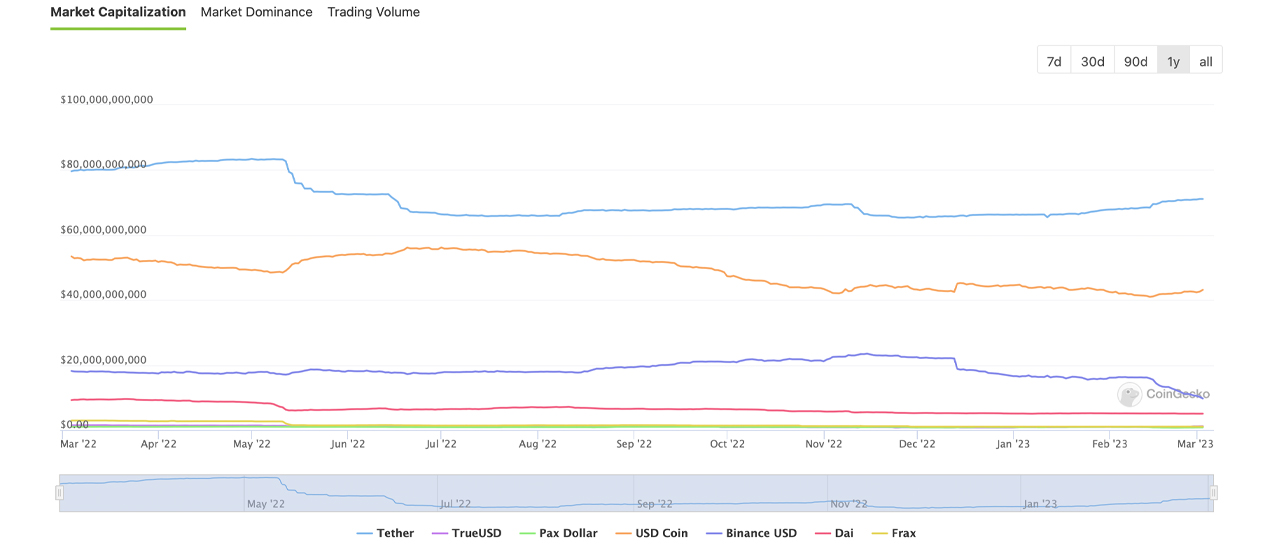

The realm of stablecoins is an ever-evolving landscape and the number of coins in circulation for the stablecoin BUSD has fallen below the 10 billion mark to approximately 9.68 billion on March 3, 2023. Over the last 30 days, BUSD’s token supply has dropped 40% lower. In contrast, the number of tethers in circulation has increased by 4.7% to 71.11 billion in the last month.

BUSD Slips Below $10 Billion, Tether Supply Rises by 4.7% to Over $71 Billion

In the stablecoin economy, currency supply fluctuations are key drivers of change. As of Friday, March 3, 2023, the stablecoin economy has a valuation of $136 billion, and stablecoins account for $47 billion of the world’s trade volume over the last 24 hours. The supply of BUSD has dropped significantly and now stands at 9.68 billion, representing roughly 0.901% of the entire crypto economy’s net value. In contrast, the top two largest stablecoins by market capitalization, USDT and USDC, have seen increases in terms of coins in circulation over the past 30 days, while BUSD’s supply continues to plummet.

This month, the supply of tether (USDT) has risen 4.7%, surpassing 71 billion coins. Usd coin (USDC) has also seen a 1.7% increase, with 43.16 billion coins in circulation. However, the supply of three other top stablecoins, namely DAI, pax dollar (USDP), and gemini dollar (GUSD), has diminished. DAI’s supply has decreased by 2.1% this month, while USDP has dipped 20.2% lower. Similarly, GUSD’s supply has also slid 2% lower over the last 30 days. In contrast, trueusd’s (TUSD) supply has increased by 22.5% over the last month, reaching 1.16 billion coins.

USDD and FRAX have also experienced increases, with USDD rising slightly by 0.2% over the past month and FRAX climbing by 1.1% compared to the previous month. Together, all nine aforementioned stablecoin assets make up 70.22% of the 24-hour trading volume. Before the Terra stablecoin depegging event, the stablecoin market was more predictable and exhibited steady growth. The declines in recent times, however, demonstrate the current unpredictable nature of the stablecoin market.

What do you think the future holds for stablecoins in light of recent supply fluctuations? Share your thoughts about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

[ad_2]

Source link