Economist Peter Schiff Warns About a New, Incoming Great Depression Crisis, Criticizes Misleading Inflation Numbers – Bitcoin News

[ad_1]

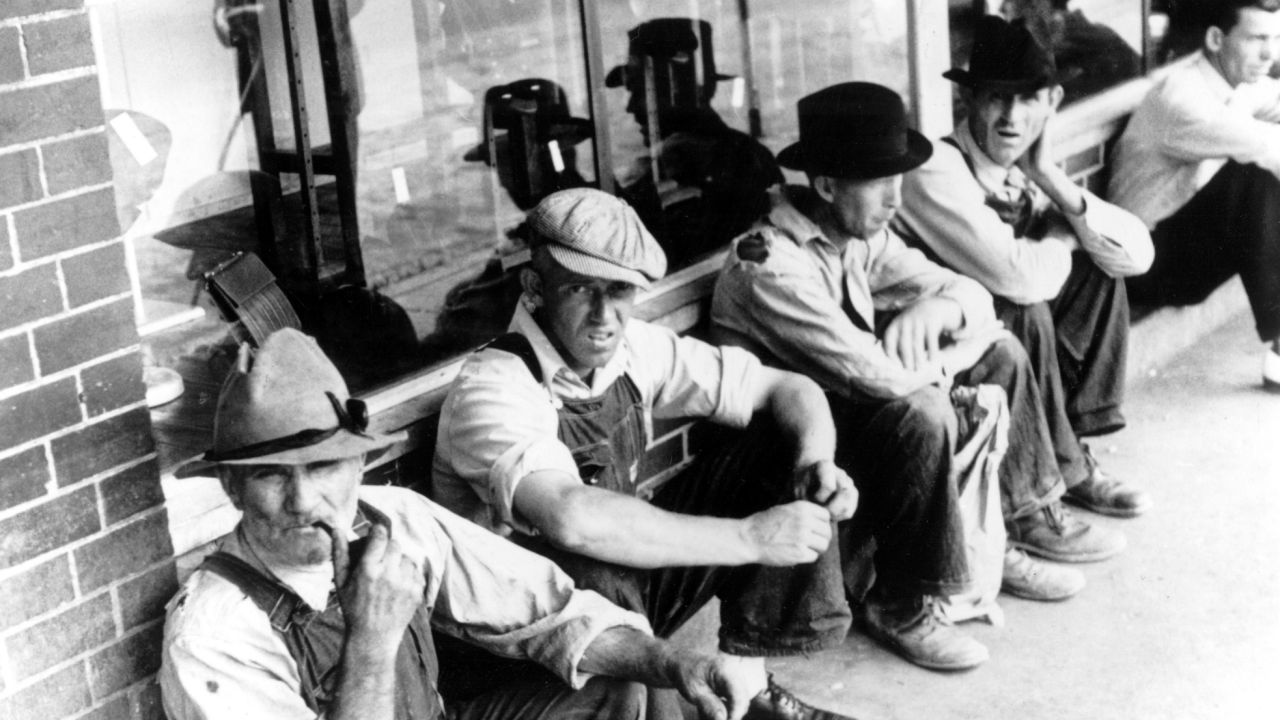

Peter Schiff, best-selling author and chief economist of Europac, has warned about the coming of a new great depression period in America. In an interview, Schiff stated that official Consumer Price Index (CPI) numbers were designed to mislead the public and that the country was going to face a depression worse than the one it faced back in the 1930s.

Peter Schiff Warns of Great Depression With Prices Rising

Peter Schiff, economist and best-selling author, has warned about an upcoming economic crisis that will unleash a new Great Depression far worse than the one the U.S. faced back during the 30s. In an interview, Schiff commented that this crisis will be in part originated by the high inflation levels that the government is fueling by increasing public spending, which will affect the qualification of the U.S. public debt.

Schiff stated:

We’re going to have a crisis because we do raise the debt ceiling. Because we’ve continued to raise that debt ceiling instead of dealing with the real problem, which is not the ceiling, but the debt. The ceiling would be the solution to the problem if they only stopped raising it.

The economist explained that this upcoming new Great Depression will be different due to the continued rise of prices and the loss of purchasing power of Americans. Schiff declared:

It’s probably going to be worse. It is a depression, but unlike the depression of the 1930s, where the people at least got the benefit of falling prices that provided some relief. This time, even the people who don’t lose their jobs are going to suffer because they’re going to lose the value of their paychecks.

How Inflation Numbers Can Be Misleading

Schiff also criticized the way the Consumer Price Index (CPI), data used to determine inflation, is calculated, stating that it is designed to give a low result. He said that “you basically have to double the official numbers to get a better idea of what’s actually happening with prices,” indicating that the real inflation number should be currently closer to 10%.

Even so, Schiff believes that high interest rates will not be able to control inflation and that the U.S. will have to deal with both. “Interest rates are prices. It’s the price you pay when you borrow money. The price is going up, just like the price of everything else,” he explained. Finally, he remarked that “as interest goes up, well, that’s just another cost that you need to pass on to your customers through higher prices.”

What do you think about Peter Schiff and his warning about an upcoming great depression? Tell us in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

[ad_2]

Source link