[ad_1]

The amount of Ethereum staked on the network could be as much as twice the amount that is held on centralized exchanges. However, as the Ethereum staking narrative continues to strengthen, it is not being reflected in asset prices, which remain weakened.

As the amount of Ethereum on centralized exchanges dwindles, more of it is going into self-custody and staking.

Ethereum Staking Surges

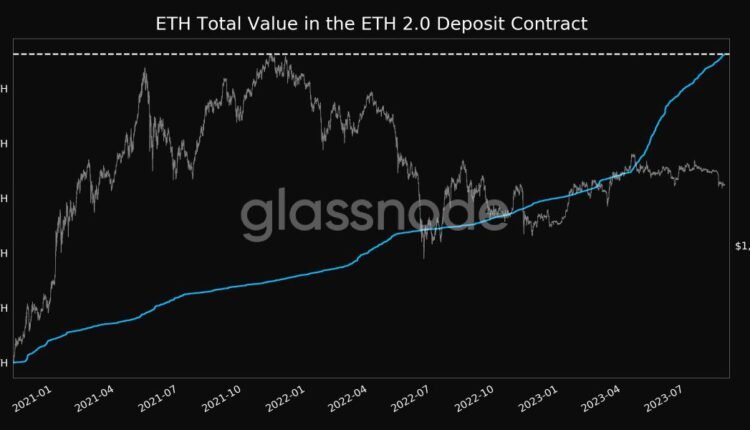

On Aug. 28, crypto YouTuber Lark Davis referenced two recent Glassnode charts. The charts showed a staking balance that was just over 28 million ETH and an exchange balance that had fallen to 14.7 million ETH.

“Almost twice as much ETH being staked versus ETH available for sale on exchanges. That’s insane!”

There are a few discrepancies between the figures, but the overall trend is clear. Glassnode has depicted a decline in ETH on exchanges since mid-2020, which has fallen by more than 50% over the past three years.

The Ultrasound.Money portal reports a total of 24.3 million ETH staked, which is now over 20% of the total supply. At current prices, that is valued at a cool $40 billion – and that is in the middle of a bear market.

Nansen reports a slightly higher figure staked at 26.1 million ETH, which is also a new peak. Moreover, staking deposits are outpacing withdrawals at the moment, keeping the total at new highs.

Top Dog ETH Stakers and Lackluster ETH Prices

Liquid staking platform Lido has the largest share, with around a third of the total stake. Its 8.3 million ETH is valued at roughly $14 billion at current prices. Rocket Pool has around 3% of the total, with roughly 800,000 ETH staked.

The largest centralized exchange staking provider is Coinbase, with 9% of the total, or 2.37 million ETH. Binance, which charges much lower commissions, has 4.6% or 1.2 million ETH staked.

Despite this bullish fundamental property of Ethereum, its prices remain depressed. ETH is trading flat on the day at $1,650 at the time of writing.

Prices have moved very little over the past week, clinging on to this new support level. Ethereum has dropped 12% over the past month and remains 66% down from its peak in November 2021.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link