[ad_1]

The United States Securities and Exchange Commission (SEC) has ushered in a new chapter in crypto investing. It greenlighted the Volatility Shares’ 2x Bitcoin Strategy ETF (BITX), the first leveraged crypto ETF in the US.

The historic move sets the stage for the ETF’s impending launch next Tuesday.

SEC Approves First Leveraged Bitcoin ETF

Stuart Barton, the CEO of Volatility Shares, underscored the appeal of integrating digital assets into ETF frameworks.

The BITX ETF represents a bold innovation in crypto investment. It offers customers the potential to gain exposure to Bitcoin by only staking half its value. The ETF’s alignment with the CME Bitcoin Futures Daily Roll Index adds a layer of confidence in its financial mechanics.

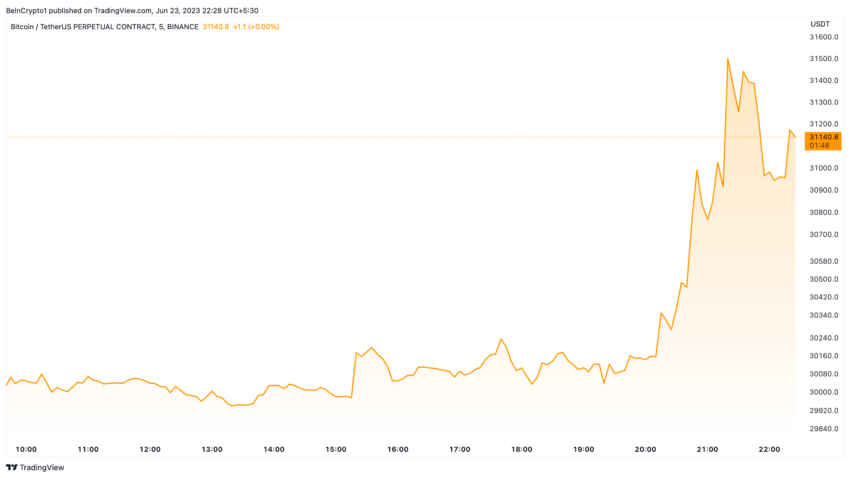

This watershed moment occurs as Bitcoin’s value ascends past the $31,000 milestone. The upswing has been spurred by major traditional investment companies such as BlackRock filing applications for spot Bitcoin ETFs.

Although futures-based ETF products are not newcomers in the trading scene, the SEC has maintained a firm stand against the launch of spot products.

Notwithstanding the series of rejections other leveraged Bitcoin futures products face, the BITX ETF approval is a breakthrough. It signals a cautious yet considerable shift in the SEC’s stance on crypto-related offerings. It reinforces the robustness and legitimacy of Bitcoin futures as an asset class.

While the ramifications of the leveraged futures Bitcoin ETF approval are far-reaching, investors should exercise caution, understanding that the enhanced exposure also magnifies the risks.

This is a developing story…

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link