[ad_1]

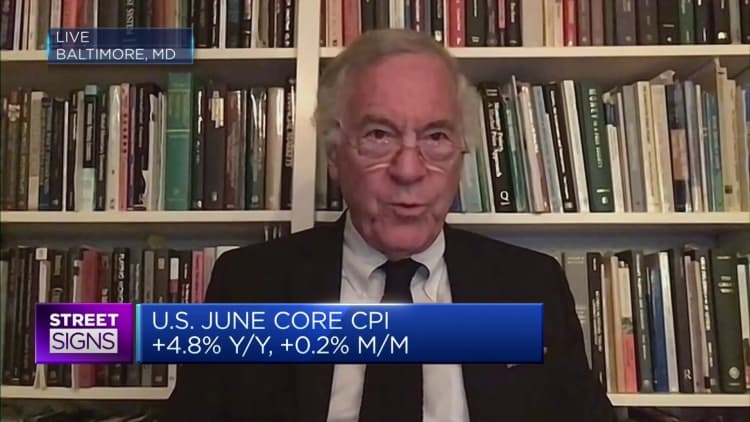

The U.S. no longer has an inflation problem, according to veteran economist Steve Hanke.

“I think the inflation story is history. One reason for that is that money supply has been contracting on a year-over-year basis by minus 4% in the United States,” Hanke, a professor of applied economics at Johns Hopkins University, told CNBC’s “Street Signs Asia” on Thursday.

“We haven’t seen that since 1938,” Hanke said. “Money supply changes cause changes in the price index and inflation.”

Prices are displayed in a grocery store on February 01, 2023 in New York City.

Leonardo Munoz | Corbis News | Getty Images

U.S. inflation rate for June came in lower than expected at 3% on Wednesday, the smallest year-on-year increase in two years. The core consumer price index, which strips out volatile food and energy prices, rose 4.8% from a year ago and 0.2% month-on-month.

The latest data could give the Federal Reserve some wiggle room as the central bank navigates its interest rates policy direction.

U.S. producer price index is due later Thursday. If it also shows prices falling that could further influence the Fed’s decision to end the rate hiking cycle soon.

Traders are betting there’s a 92.4% chance that the Fed will keep rates unchanged at its July meeting, according to the CME FedWatch tool.

“When inflation was going and roaring, the producer price index roared up first and then the consumer price index roared up. And then finally the core gradually like a snail went up,” said Hanke.

Forget all the propaganda we’re hearing — that the chairman of the Federal Reserve has a tough problem, that this is going to be a long fight, things are sticky and so forth. Things aren’t sticky.

Steve Hanke

Professor, Johns Hopkins University

“Now, we’ve turned the thing around and the producer price indexes are falling like a stone. The consumer price index, it’s falling pretty much like a stone. And the core is lagging way behind,” he said, adding: “We’ll see all of that come down as long as they continue with quantitative tightening.”

Central bank policymakers tend to look more at core inflation, which is still running well above the Fed’s 2% annual target.

But Hanke noted that if the Fed continues “to keep doing what they’re doing,” it can reach the “2% range pretty fast.”

“Forget all the propaganda we’re hearing — that the chairman of the Federal Reserve has a tough problem, that this is going to be a long fight, things are sticky and so forth. Things aren’t sticky,” noted the professor.

— CNBC’s Jeff Cox contributed to this article

[ad_2]

Source link