[ad_1]

Vitalik Buterin applauds the “builder” culture the Bitcoin’s Ordinals project’s rise is bringing to counteract the “laser-eye” movement championed by maximalists.

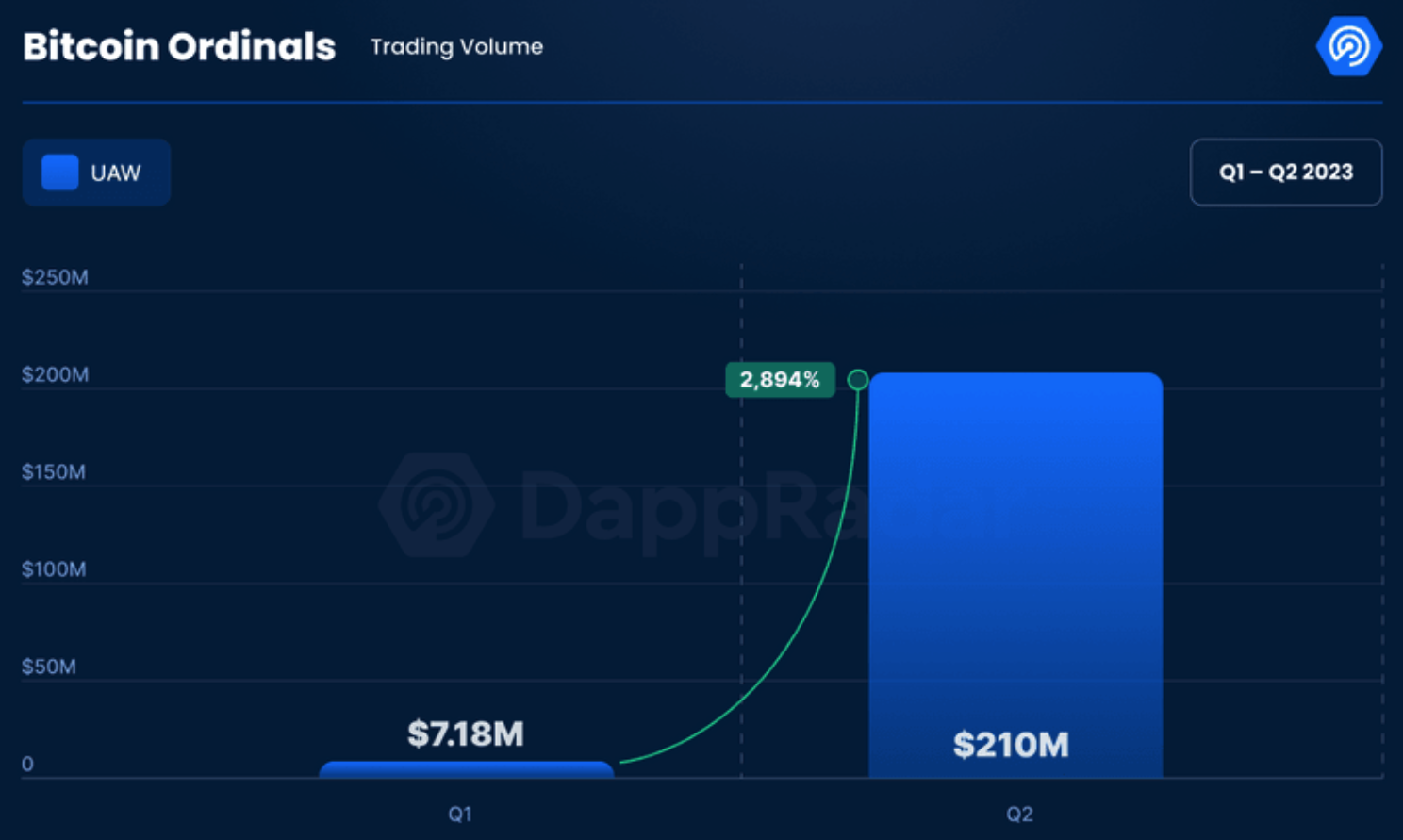

Trading volume for Bitcoin’s ordinals rose 2834% from Q1 to reach $210 million in Q2, as per the latest DappRadar report.

Ordinals Rise Can Help Bitcoiners Learn From Ethereum’s Builder Culture

The number of trades and unique traders also rose to 554,215 and 150,969.

Bitcoin’s Ordinals protocol “inscribes” data of digital files on Satoshis, the smallest unit of exchange on the Bitcoin blockchain. It then tracks these Satoshis as they move through the Bitcoin.

Developer Casey Rodamor pioneered the Oridnals protocol after Bitcoin’s Taproot upgrade. The project has increased demand for block space on the network and helped create a healthier fee market.

Learn here how to make money with Bitcoin.

In a conversation with former Bitcoin Maxi Eric Wall, Buterin said that Ordinals builders could learn how to drive further development from Ethereum’s smart contract developers.

Ethereum, co-founded by Buterin in 2015, was the first blockchain with a programmable smart contract language. Its use has been limited by its limitations in scaling transaction throughput to match payment networks like Visa and Mastercard.

Recent changes have prepared the network for its long-term goal of handling more transactions through danksharding. In the meantime, other projects called rollups have sought to process some transactions offchain and bundle them before sending them to Ethereum for confirmation.

Despite its low transaction throughput, Ethereum’s decentralized finance ecosystem is the largest, with over $26 billion locked.

Buterin Says ‘Maximalism is Crazy’, But the Next Step is Programmability

According to Buterin, the new Bitcoin builder culture depicts a growing resistance to the laser-eyed movement of most Bitcoin maximalists. Maxis believes, among other things, that most digital assets other than Bitcoin do not conform to the ideals of decentralized currency.

In the Twitter Spaces, Buterin said,

“Maximalism is crazy.”

The next step is a more programmable system, he argued.

Prominent supporter Michael Saylor said that Ethereum is a security because a team of core developers can fundamentally change the issuance pattern of the blockchain’s native currency ETH. However, Bitcoin is a commodity because its features cannot be changed, he argued last year.

A recent JPMorgan research report said Ethereum was neither a commodity nor a security. The asset’s status has been hotly debated during a court case between Ripple Labs and the US Securities and Exchange Commission. Internal SEC documents from 2018 recorded an unknown party suggesting that Ethereum is not a security.

Got something to say about the rise in the volume of Ordinals, Bitcoin’s NFT protocol, or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or Twitter.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link