[ad_1]

The cyclical nature of the crypto market allows investors to plan their earnings. Many consider Bitcoin (BTC) halvings to be the main driver of price growth in the crypto industry. The next one will take place in the spring of 2024.

BeInCrypto editors discussed with the experts to find out which cryptocurrency can potentially help investors make money on the Bitcoin halving.

Why Crypto Market is Growing

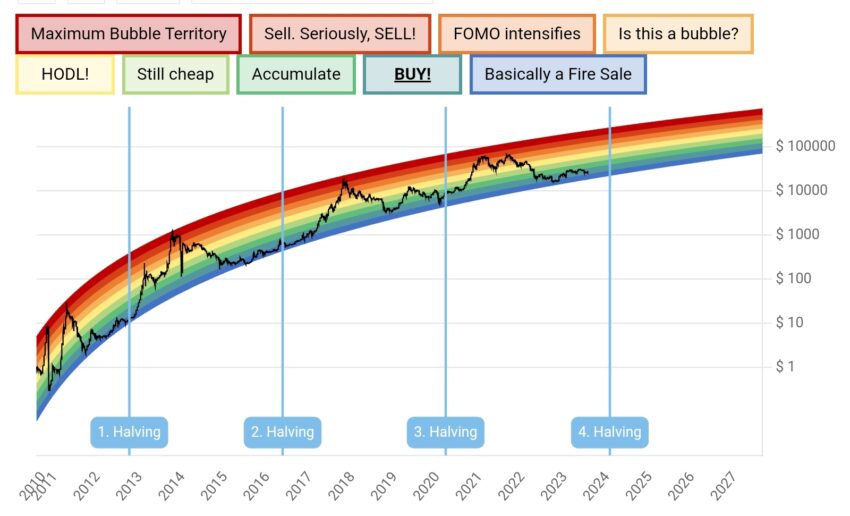

Movements in the digital asset market are cyclical. Each cycle, which consists of a growth phase, subsequent correction, and lateral movement, lasts approximately four years. The reason is that every 210,000 mined blocks, or approximately every four years, halvings occur in the network of the most capitalized cryptocurrency – Bitcoin (BTC). The term means a halving of the block rewards.

Click here to learn more about Bitcoin halving cycle investment strategies.

There have already been three halvings in the history of Bitcoin: in 2012, 2016, and 2020. The next one will be in the spring of 2024. Bitcoin reacted to all three halvings with growth, updating the all-time high (ATH) value approximately a year and a half after the event.

Then the coin went into a correction and then sideways, after which BTC waited for a new decrease in the mining speed and a repeat of the cycle.

Since Bitcoin is the flagship of the crypto market, most other cryptocurrencies follow its movements. Therefore, during the period when the BTC rate updates ATH, many other coins also set a new price maximum.

The 2024 Bitcoin halving is on the horizon. It can be assumed that BTC will once again react to the event by hitting a new ATH, and other coins will follow the example of the flagship.

Many altcoins grow faster than Bitcoin. So, the problem of choice arises.

Which Cryptocurrency Should Investors Buy After Bitcoin Halving?

StormGain cryptocurrency exchange expert Dmitry Noskov shared his first vision with us. According to Noskov, investors, firstly, should buy Bitcoin. Among altcoins, Noskov highlighted XRP. In his opinion, positive news about resolving the conflict between the issuer of the coin, the Ripple crypto project, and the US Securities and Exchange Commission (SEC) can set a good trajectory for the growth of its rate.

Bitget managing director Gracie Chen also believes that investors should firstly pay attention to Bitcoin. Chen also drew attention to the prospects for crypto project tokens offering Layer 2 (L2) blockchain solutions. They are add-ons over the main blockchains that help reduce transaction costs and speed up transaction times.

Click here to learn more about the top 5 cryptos not to miss in summer 2023.

In her opinion, with the crypto market’s development, the need for Layer 2 solutions will grow, pushing the tokens of such projects upward.

Co-founder of 1ex Trading Board Anton Nozdravchev also joined the discussion. Nozdravchev prefers top coins such as Bitcoin and Ethereum (ETH).

Summing up, the industry figures interviewed by BeInCrypto believe that investors should first purchase Bitcoin. In second place are popular altcoins such as Ethereum and XRP. It is also worth paying attention to Layer 2 solution tokens. The popularity of the technology can push the price of such coins up.

However, investors should always do their own research before making any investing decision. They should also consider the risks as the cryptocurrency markets are highly volatile.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link