[ad_1]

The US Securities and Exchange Commission (SEC) has imposed a $1.75 million fine on VanEck, a Bitcoin exchange-traded fund (ETF) issuer, citing disclosure failures.

According to the SEC, VanEck neglected to inform the board overseeing its Social Sentiment ETF (BUZZ) about a prominent social media influencer’s involvement.

VanEck Did Not Admit Nor Deny SEC Findings

The SEC did not mention the influencer’s identity in its statement. However, Bloomberg’s analyst Eric Balchunas explained that Dave Portnoy, Barstool Sports’s founder, was the person involved.

“[VanEck] didn’t disclose to fund board that ‘well-known and controversial’ social media influencer Dave Portnoy was getting paid by the index company on sliding scale in order to help incentivize promotion of their ETF,” Balchunas said.

VanEck refrained from either admitting or denying the SEC’s findings. Still, the firm consented to a cease-and-desist order, a censure, and a substantial monetary penalty.

Andrew Dean, co-chief of the Enforcement Division’s Asset Management Unit at the SEC, stressed the critical importance of accurate disclosures for fund boards, particularly regarding matters that could potentially impact advisory contracts.

“Van Eck Associates’ disclosure failures concerning this high-profile fund launch limited the board’s ability to consider the economic impact of the licensing arrangement and the involvement of a prominent social media influencer as it evaluated Van Eck Associates’ advisory contract for the fund,” Dean added.

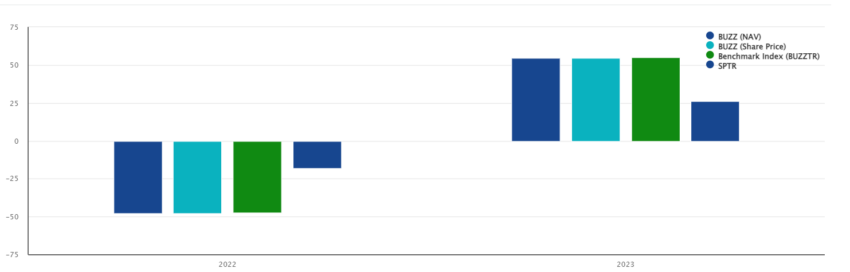

VanEck’s BUZZ ETF is designed to track a basket of 76 large-cap US stocks that exhibit a notable degree of positive investor sentiment. It is influenced by various online content sources such as social media platforms, news articles, and blog posts.

Notable companies included in this ETF are Coinbase, Microsoft, Tesla, Alphabet, AMD, Nvidia, Meta, Apple, and MicroStrategy.

Revised Spot Ethereum ETF Application

Despite the recent regulatory setback, VanEck amended its application for a spot Ethereum ETF through an S-1 filing with the SEC on February 16.

The updated document showed that the ETF would feature a cash creation and redemption mechanism. In January, the regulatory agency favored this process for approving spot Bitcoin ETFs, with VanEck’s HODL being one of them.

Finance lawyer Scott Johnson pointed out that VanEck’s filing does not show if the firm has staking plans. Amendments from other applicants like Ark Invest and 21Shares had a section about possibly staking the assets to earn rewards.

Meanwhile, the ETF filing reflects the broader industry’s anticipation of a potential approval of an Ethereum fund following the success of spot Bitcoin ETFs. The SEC will decide on multiple spot ETH ETF applications by May.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

[ad_2]

Source link