[ad_1]

A recently amended Schedule 13D form filed with the SEC revealed that a consortium of 19 investors, including Sequoia Capital, Andressen Horowitz, and Binance, are backing new Twitter CEO Elon Musk in his $44 million purchase of the social media platform.

The development also comes as Musk surged his financing commitment to $27.25 billion, according to a report by Reuters, reducing Morgan Stanley’s margin loan to $6.25 billion from an earlier $12.5 billion.

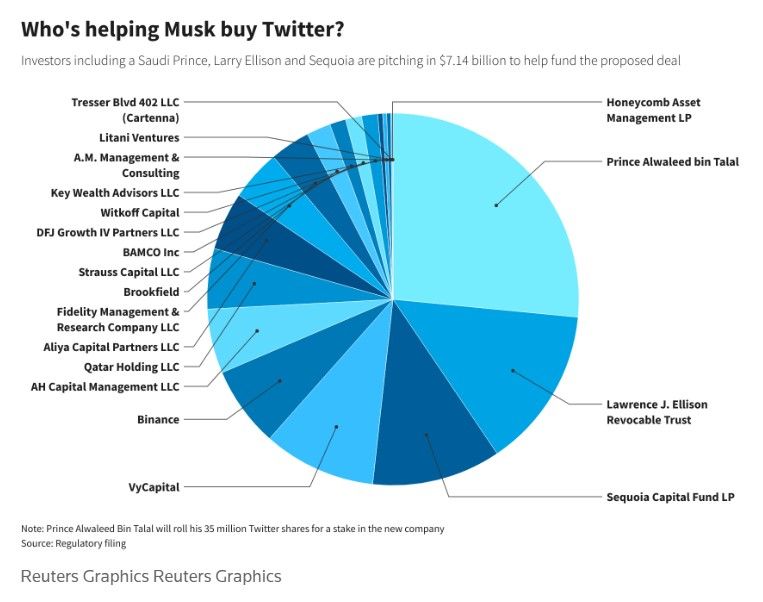

According to reports, the list of VCs and funds have allocated around $7.1 billion for the deal, with the highest commitment coming from Lawrence J. Ellison Revocable Trust at $1 billion. Oracle co-founder Larry Ellison, was also appointed to Tesla’s Board of Advisors in 2018.

Saudi Arabia’s Prince Alwaleed bin Talal, who had previously opposed the deal on Twitter, is also ready to contribute his stake of 35 million shares (approx. $1.9 billion) in the buyout.

Enter Binance

Binance has also earmarked $500 million to finance the bid.

However, Binance CEO Changpeng Zhao has also expressed his desire to bring Twitter and Web3 together in the course of the deal.

“We hope to be able to play a role in bringing social media and web3 together and broadening the use and adoption of crypto and blockchain technology,” CZ said in a recent statement.

In an earlier interview with Bloomberg TV, CZ had remarked that Binance will invest in any “strong business with existing users, existing models” that will aid additional monetization models with Web3, blockchain and crypto.

What changes can the Twitter sphere expect?

With the buyout deal expected to close later this year, Twitter’s leadership is also expected to change. Sources close to Twitter told Reuters on Thursday that Musk is expected to take on the temporary role of CEO after securing the deal, replacing Twitter’s current CEO Parag Agrawal.

Currently, Musk has been recommending a series of changes for the platform, including adding a “slight cost” for commercial/government users.

Twitter advertisers are also reportedly keeping a close eye on the business and how it might evolve with the new owner.

While reports say that there has been no ad loss to the platform yet, advertisers are curiously waiting for updates.

“[Musk is] like the ghost of Christmas future hanging over this whole thing,” said Mark DiMassimo, founder of ad agency DiMassimo Goldstein, referring to the platform’s ad presentation. “Whatever [Twitter] says, all anyone really wants to know is how this will be in the future.”

Could Musk walk out of the deal?

While Musk is ready to eliminate content moderation and offer ‘absolute’ free speech on the platform once he takes over, there is another possibility.

What if he walks out on the deal?

If the Tesla chief decides to back off from the ongoing deal, he would owe a $1 billion termination fee to Twitter, according to Reuters. Additionally, the platform could initiate a lawsuit against Musk for breaching the current terms of the agreement.

What do you think about this subject? Write to us and tell us!

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

[ad_2]

Source link