BIS Economists Recommend 3 Crypto Policies for Regulators Worldwide to Adopt – Regulation Bitcoin News

[ad_1]

Economists at the Bank of International Settlements (BIS) have recommended three policies regulators worldwide could adopt in order to deal with the risks posed by cryptocurrencies. “Authorities can now consider a variety of policy approaches and at the same time work to improve the existing monetary system in the public interest,” they advised.

BIS Economists Discuss Crypto Policies

The Bank of International Settlements (BIS) published a bulletin last week titled “Addressing the risks in crypto: laying out the options.”

Authored by BIS economists Matteo Aquilina, Jon Frost, and Andreas Schrimpf, the report discusses the risks associated with cryptocurrencies and the various options available to regulators and central banks for addressing these risks.

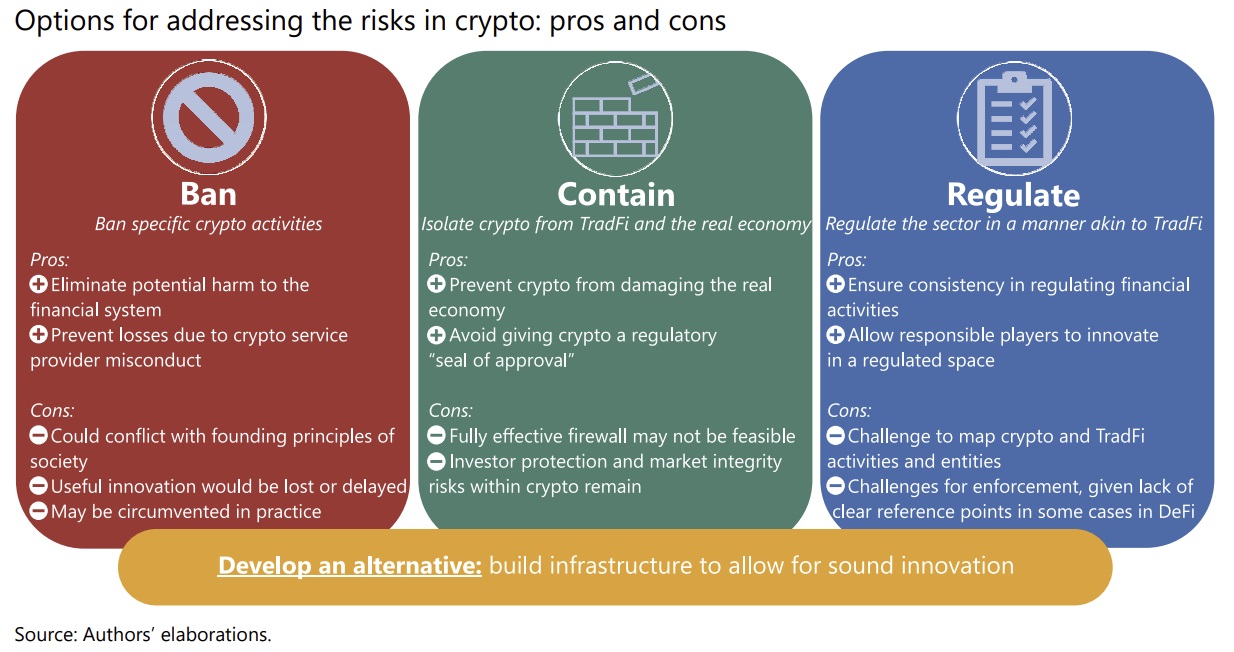

The authors outlined “three potential lines of action.” The first is to “ban specific crypto activities.” Another option is to “isolate crypto from tradfi [traditional finance] and the real economy.” The third is to “regulate the sector in a manner akin to tradfi.” However, the report clarifies that the three options are not mutually exclusive and could be “selectively combined to mitigate the risks emanating from crypto activities.”

While noting that crypto markets “have experienced a remarkable series of booms and busts, often resulting in large losses for investors,” the BIS economists concluded that “these failures have so far not spilled over to the traditional financial system or the real economy.” Nonetheless, they cautioned:

There is no assurance that they will not do so in the future, as defi (decentralized finance) and tradfi become more intertwined.

“Authorities can now consider a variety of policy approaches and at the same time work to improve the existing monetary system in the public interest,” the BIS report concludes.

What do you think about the BIS economists’ crypto-policy recommendations? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

[ad_2]

Source link